Hiring a Controller is one of the most strategic financial decisions a company can make. The right Controller doesn’t just “keep the books”—they guide financial decisions, enforce discipline, lead teams, and help shape the operational integrity of the organization.

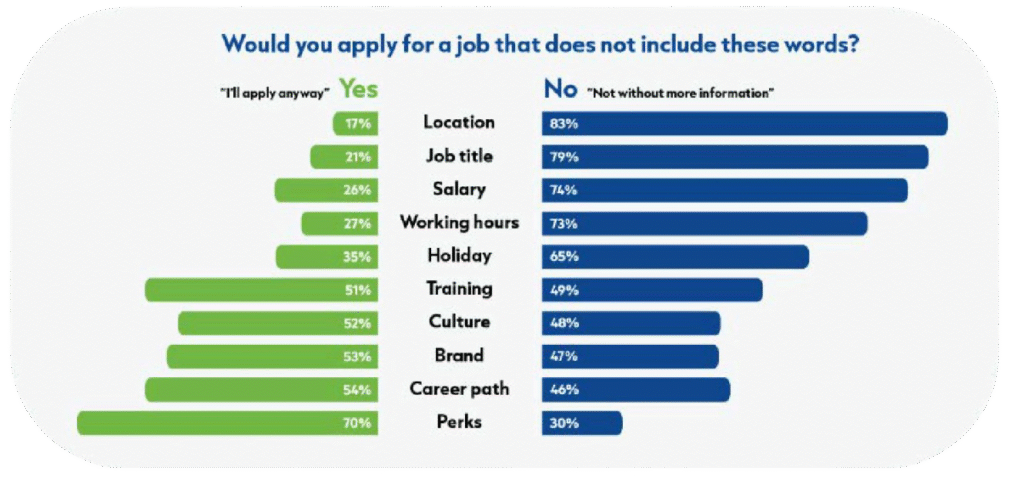

Below are the results from a general survey done by LinkedIn regarding the likelihood a person would apply to and job application.

Some of this information may come across as normal or standard, but others are alarming. Such as, 46% of people won’t apply if “Career path” is not included.

If your Controller job description doesn’t clearly communicate the scope, importance of the role and the general items above you may miss out on professionals with the experience and leadership your business needs.

Here are our 7 best practices for writing a job description that speaks directly to high-performing Controllers:

1. Use a Clear, Industry-Aligned Job Title

Keep the title clear and reflective of the role’s level. Most experienced Controllers will search using standard terminology. Small to midsize companies without depth in their accounting/finance org chart should avoid creative or reduced titles.

Use: “Corporate Controller,” “Plant Controller,” or “Controller – Multi-Entity Operations”

Avoid: “Finance Lead,” “Senior Accounting Supervisor” (if the position oversees full-cycle accounting and strategic finance) or “Assistant Controller” (when this position does not report to a Controller).

If your company is in transition or planning future growth and you are hiring for a role today but want someone you can see growing into your needs tomorrow, you might indicate that in the title (e.g., “Controller – Future CFO Track”).

2. Open with a Company and Strategic Role Overview paragraph

At the Controller level, candidates want to know:

- Where the company stands financially and operationally

- Where the company is going

- Who they’ll report to

- What they’ll lead

- Why the position exists now

Example Opening Paragraph:

BEST MANUFACTURER is a 20-year-old privately held company that has recently partnered with BEST FIRM private equity group to expand operations into a multi-state company. We are seeking a strategic and hands-on Controller to lead our accounting operations, ensure GAAP compliance, and partner with executive leadership on financial planning and decision-making. Reporting to the CFO, this position will manage a team of four and play a critical role in modernizing our systems and scaling our finance operations as we prepare for national expansion.

OR

BEST MANUFACTURER is a 20-year-old family held company transitioning into second generation leadership. We are seeking a strategic and hands-on Controller to lead our accounting operations, drive process improvements, and serve as a key partner to executive leadership. This is a succession-focused role reporting directly to our long-standing CFO, who is planning retirement within the next 12–24 months. The ideal candidate will bring both operational excellence and long-term leadership potential, with a clear path to transition into the CFO role.

The Controller will oversee a team of four and play a critical role in ensuring GAAP compliance, managing audits, modernizing systems, and strengthening internal controls. This is a unique opportunity for a finance leader ready to step into broader strategic responsibilities while being mentored by a tenured CFO during a defined leadership transition.

3. Define Responsibilities with Both Leadership and Technical Depth

Controllers aren’t just technicians—they’re also department heads, policy setters, and business advisors. Your job description should reflect this hybrid nature.

Example Responsibilities:

- Lead and oversee the monthly, quarterly, and annual close process across multiple entities

- Ensure compliance with US GAAP, internal controls, and audit readiness

- Develop and implement accounting policies and procedures for scalability

- Partner with the CFO on budgeting, forecasting, and cash flow planning

- Supervise and mentor a team of accountants and analysts

- Manage external audits and coordinate with tax advisors

- Drive ERP optimization and process automation efforts

Make sure to indicate team size, reporting structure, system ownership (e.g., ERP, financial reporting tools) and any responsibilities of compliance under city, state or Federal regulatory bodies. If technical knowledge is needed in certain areas (e.g., Revenue Recognition, Leasing Standards, or Percentage of Completion Accounting) make sure to identify this.

4. Set Clear, Realistic Qualifications

Experienced candidates appreciate precision. Be direct about must-haves vs. nice-to-haves and avoid including every possible skill under the sun.

Required:

- Bachelor’s degree in Accounting or Finance

- 8+ years of progressive accounting experience, including 3+ years in a management or Controller-level role

- Strong knowledge of GAAP and internal controls

- Experience leading audits and managing a full close cycle

- Proficiency with ERP systems (e.g., NetSuite, SAP, Sage)

- CPA designation

Preferred:

- MBA or relative graduate degree

- Experience in a manufacturing or multi-entity environment

- Background in private equity-backed or public accounting

5. Showcase Company Culture, Values, and Leadership Dynamics

Controllers are often culture carriers and change agents. Help them understand how your finance team operates, what leadership looks like, and how decisions get made.

Example:

Our organization operates with transparency and accountability. The finance team works cross-functionally with operations, HR, and sales to ensure aligned decision-making. As Controller, you’ll have the opportunity to formalize policies and build systems while contributing directly to leadership strategy meetings.

Also mention:

- Is this a new role due to growth?

- Is it being hired to replace a long-time employee?

- Is the Controller expected to step into a CFO role down the line?

6. Use Professional, Inclusive Language

Controller candidates expect polish and clarity. Avoid buzzwords like “rockstar” or “ninja,” and steer clear of gendered or age-biased language.

Instead of: “We want someone who can own it and hustle in a fast-paced environment.”

Use: “We’re looking for a confident financial leader who can build structure, implement process improvements, and lead with clarity.”

Instead of: “We need someone who can wear a lot of hats and roll with the punches.”

Use: “We’re looking for a versatile financial leader who can manage competing priorities and adapt processes to meet the evolving needs of the business.”

7. Be Transparent About the Process and Compensation Range (if possible)

At this level, ambiguity leads to skepticism. While salary transparency isn’t always possible, set clear expectations around process and timing.

Example Closing Section:

To apply, please submit your resume and a brief cover letter outlining your leadership experience. Our process includes an initial phone screening, followed by interviews with executive leadership and key cross-functional partners. We expect to fill the role within 4–6 weeks.

Compensation is competitive and includes performance-based bonuses, 401(k) match, and medical benefits. Salary range: $120,000–$150,000 depending on experience and qualifications.

Final Thoughts

An experienced Controller will evaluate your job description with the same critical thinking they apply to financial statements. If it’s vague, outdated, or inflated, they’ll walk away—or worse, passively ignore it.

Take the time to craft your job post with the same intention you expect from their leadership. You’ll attract professionals who are aligned not only with the job, but with the bigger picture of your company’s future.

Lastly, if you do not see the right candidates within the first week, consider calling us at The Clark Agency Recruiters. We are happy to work alongside your posting to attack the passive candidate market.